Under Texas law, drivers are only required to carry car insurance that protects others in the event that they cause bodily harm or property damage. This type of insurance is commonly referred to as "liability insurance.". All drivers must have auto liability insurance to cover the costs of accidents they cause.

When a driver is at fault for an accident, liability insurance pays for the repair or replacement of the other driver's car, as well as their medical expenses. The minimum required liability insurance is called "30/60/25 coverage." This means that for each accident, there is $30,000 in coverage for each injured person, up to $60,000 per accident, and up to $25,000 for property damage per accident.

While only the minimum coverage is legally required, it's a good idea to purchase additional coverage to ensure you're fully protected. If the insurance coverage is not enough to pay for the damages or medical bills, the other driver may sue you for the remaining costs. It's essential to note that liability insurance does not provide coverage for you, your car, or your personal belongings. Liability insurance only covers damages to other parties involved in an accident, and not yourself or your own vehicle. It solely covers the costs associated with damages or injuries you cause to others while driving. Essentially it is what you are liable for.

Basic liability coverage typically pays for:

If you have collision coverage, it will cover damages to your car. Additionally, underinsured or uninsured motorist coverage can cover your expenses if you are in an accident with a driver who has no coverage or insufficient coverage.

Due to the high cost of medical care and car prices, the minimum liability coverage may not be sufficient to pay for all the costs if you're found at fault in an accident. If the damages exceed your insurance limits, other drivers may sue you to recover the difference. It is wise to consider purchasing coverage higher than the state's minimum requirements to protect yourself.

When it comes to "full coverage" car insurance in Texas, it's important to note that meeting the state's required minimum coverages of 30/60/25 is legally considered fully covered. However, many people refer to "full car insurance" as having the state's required minimums plus comprehensive insurance (which helps pay for damages from events such as hail, fire, or theft) and collision insurance (which helps cover the cost to fix damage from an accident with another car). If you lease or finance your car, adding comprehensive and collision coverages to your policy may be required and mandatory.

Consider the following types of coverage to ensure comprehensive protection:

Texas requires liability insurance, but not comprehensive coverage or collision coverage. Still, buying comprehensive and collision coverage is a smart idea, especially if your car is more expensive. These coverages will pay for the repair or replacement of your vehicle if it's in an accident, stolen, or otherwise damaged as a result of a covered incident. If you're leasing or financing a car, you may be required to carry these coverages.

Uninsured or underinsured motorist coverage is not required by law in Texas. Insurance companies, however, must offer you the opportunity to add it to your policy and it must be rejected in writing if you don't want it. Keep in mind that the insurance of the driver who is at fault typically helps cover the cost of damages. Without uninsured or underinsured motorist coverage, you could be stuck with the bill if they don't have enough coverage.

Insurance companies determine your car insurance rates based on several factors, including:

Age is an important factor that affects auto insurance rates. Younger drivers are considered to be riskier and more likely to be involved in accidents. As a result, insurance companies tend to charge more for younger drivers and offer lower rates to older drivers. A 30 year old driver with a good driving record pays 60% less than a 18 year old. You have the option to either include teenage drivers on your policy or purchase a separate policy for them. Including them in your policy is generally less expensive, but it's essential to notify your insurance provider about their presence to guarantee coverage in the event of an accident. Failure to disclose this information could result in denied coverage and extra fees.

Many insurance companies offer discounts to customers who take steps to reduce their risk of loss. Some common discounts include:

Here are some possible discounts you may be eligible for when getting car insurance:

When selecting a car insurance policy, you'll have to decide on a deductible. The deductible is the amount you pay out of pocket before the insurance company pays for the rest of the loss. For instance, if you have a claim for $1,500 and a deductible of $500, the insurance company will subtract $500 and provide you with $1,000. In other words, the first $500 of your claim is not covered. Insurance companies do this in order to avoid people filing small claims. Usually insurancy companies do not want to waste processing resources for small claims. This also lowers their operating costs. Usually opting for a higher deductible results in lower premium.

There are limitations and exclusions that are not covered by standard policies. These terms are defined in your policy, and may include:

The declaration page or the front page of your policy lists important information like your insurance company name, your policy number, the amounts for each type of coverage, and the deductible you have to pay. If you don't know what coverages you have on your policy, this is the place to check.

Texas grants you specific rights listed in the Consumer Bill of Rights for auto insurance. When you buy car insurance, the insurance company has to send you a copy with your policy, so you know all your rights.

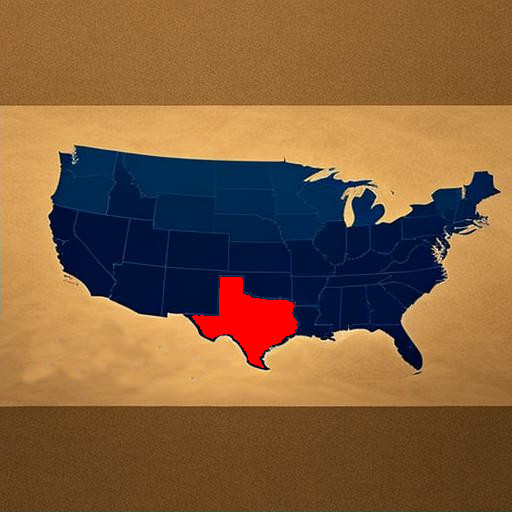

Unlike Florida or New York, Texas is not a no-fault insurance state. This means that the driver who caused an accident is also responsible for paying the cost of damages. Texas is strictly an at-fault state. For this reason, drivers in Texas should strongly consider coverages such as personal injury protection (PIP) and uninsured motorist coverage. These two coverages give you some financial protection if you are involved in an accident with an underinsured or uninsured driver. While these are technically optional coverages, they are highly recommended and must be opted out of in writing when buying your car insurance policy.

First stay calm. Gather necessary information such as name, address, license plate number, driver's license number, and car insurance information of the involved parties.

If you believe the other driver is at fault, it is also important to get contact information from anyone who witnessed the accident. Take pictures of the crash site, road condition and the weather. It is best to avoid any conversations in regards to fault. It might be possible that you were not at fault even though you think you have contributed to the crash. Collecting the proper information helps to prove your innocence.

After the accident, you will be required to file a report, form CR-2, within ten days of the accident if there isn't a police investigation because of injury, death or property damage over $1,000. If police is present then they will fill out form CR-3.

Contact your insurance company to report the accident and an investigation will be started. Your insurance company will want to evaluate the damage to your vehicle, so don't do any repairs immediately.

Limit communication regarding the accident to the police, your insurance company, or your lawyer. If contacted by the other insurance company, direct them to your insurance company or lawyer.

Form CR-2 is completed by the driver involved in a car accident, while form CR-3 is completed by a law enforcement officer who responds to the accident. Both forms are used to report car accidents in Texas that result in injury, death or property damage exceeding $1,000, but form CR-3 is a more detailed report that includes additional information about the accident.

Last Update: April 2023